Reni was along with getting approval from the lending company with the knowledge we had available plus it was a great help. Expect appraisal cost being anywhere between $1,000 to $10,000. As the first time home buyer, I had no clue where you can turn along so many questions. If we’d the extra cash than we would just be making larger payments against the mortgage in the first place, and that would save us lots of great interest cost and shorten the time it takes to pay back. I would 100% recommend Refresh to anyone trying to rebuild credit with as little hassle as you possibly can. However, it’s going to not provide you with all the answers to your queries.

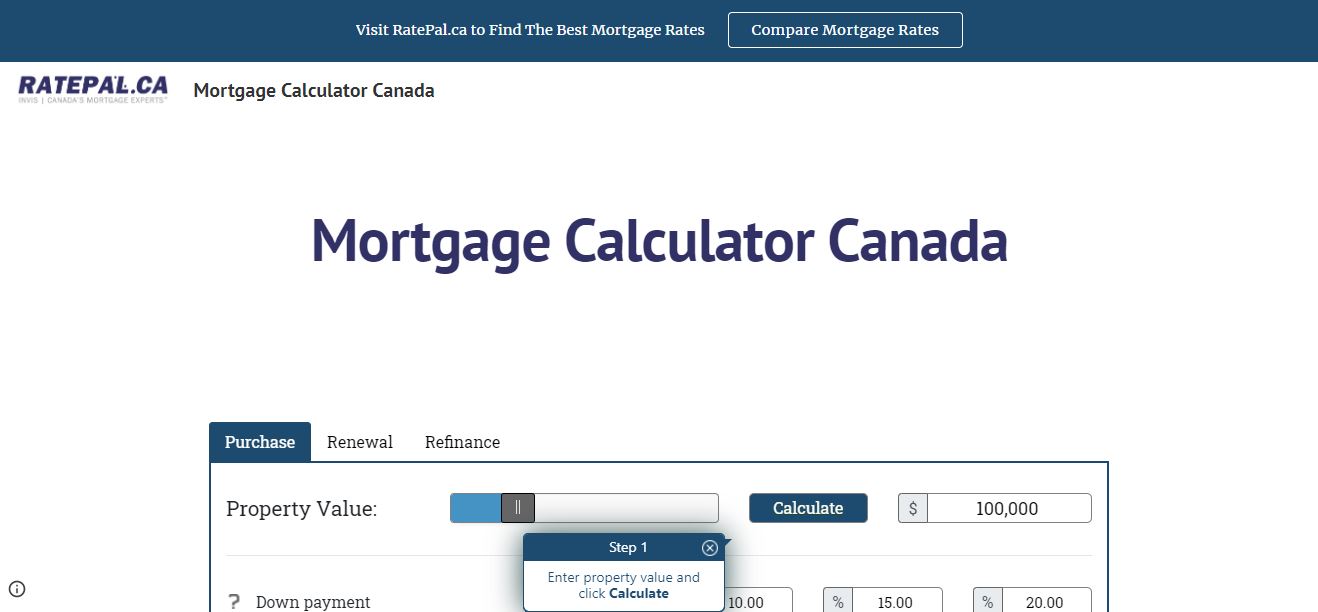

When a lender grants financing, they trust that your business will produce enough profits to cover back the mortgage calculator canada. This will save you from foreclosure and losing your lender’s trust. Paying a land-transfer tax is typically required by the buyer upon the closing of an real estate transaction. Here is a complete report on items that can influence simply how much your monthly mortgage payments will probably be:. A portion of your mortgage is going to be at a fixed price while another portion of one’s mortgage will have a variable rate that may change as Scotiabank’s prime rate changes. The spreadsheets above who have amortization tables allow you you determine the impact of lump-sum extra payments made on any payment date. Possible changes include renegotiating the rate and also other details in the contract for your next term. With a Made-to-Measure mortgage, you’re in a position to divide your mortgage into smaller portions.

It is needed on all mortgages with deposit of under 20%, which are known as high-ratio mortgages. SBA 7(a) loans fully amortize and typically paid up to 25 years or so. Mortgage guidelines in Canada include limits on minimum down payment, maximum amortization periods, and mandatory mortgage default insurance or CMHC insurance for sure mortgages. By matching the payment to your cashflow, incremental changes are easy to create and do not require much guess work. Individual buyers have taken care of immediately affordability issues by extending the duration with their loans. My wife and I first met Reni a few years ago as our Financial Advisor at the major financial institution. These can help you decide if prioritizing your mortgage is a lot more important that other expenses.

Her sincere compassion and dedication is displayed as she is definitely available to respond to every question and cope with any obstacles that will arise. The reverse mortgage calculator canada enables them to buy their home without having to pay for that home using a 100% cash investment but still have no monthly mortgage payment. The balance is paid down slightly with each payment, and this decreases the interest cost slightly to the next loan payment. Most lenders will work with borrowers to come up which has a suitable payment arrangement plan. Shop around for that best type of loan you will get, and consider using a mortgage broker to negotiate in your behalf.